All taxpayers have the right to appeal the assessed value of their property. Taxpayers can appeal their information informally to the Wake County Tax Administration or formally to the Board of Equalization and Review (BOER). For both, taxpayers are encouraged to submit documentation as to why the assessed value does not reflect fair market value and/or to provide additional information about property characteristics that may influence the assessed value.

There is no charge to file an appeal. Please note: appeals only pertain to the assessed value; appeals based solely on county or municipal tax rates cannot be considered.

Important Dates

Requests for informal reviews may be submitted between January 16, 2024–March 1, 2024, 11:59 PM local time. Tax Administration will notify taxpayers of results by mid-April 2024.

Requests for a formal appeal must be submitted between March 2, 2024–May 15, 2024, 11:59 PM local time.

Board of Equalization and Review hearings are underway. Appeals are not necessarily reviewed in the order in which they are received. Please call 919-857-3800 or email revaluation@wake.gov if you wish to inquire about the status of your timely filed appeal.

2024 Revaluation Appeals Process

Informal Review

An informal review begins when a taxpayer submits a request for an informal review online in Wake County’s Tax Portal, by mail, or in person. Often this involves providing Tax Administration clarification regarding property characteristics, a recent appraisal supporting an opinion of market value, or any other information in support of the taxpayer’s opinion of value. The request will be reviewed by a tax office appraiser, who may contact the appellant if they have questions. Once the appraiser has reviewed the information, they will decide whether a change in assessed value is supported. In either case, the appellant (and owner, if different) will be sent a letter with the outcome. The letter will include the new assessed value if applicable. If the taxpayer agrees, no additional steps are needed. If the taxpayer wants to further appeal, they can submit a formal appeal to the Board of Equalization and Review.

Formal Appeal

Taxpayers may choose to not submit an informal review and instead appeal directly to the Board of Equalization and Review (BOER). Unlike an informal review performed by an appraiser in the Tax Administration office who also decides the result, the result of a BOER appeal is decided by the Board at a hearing. The BOER considers both information submitted by the appellant and the opinion of the County appraiser when making a decision.

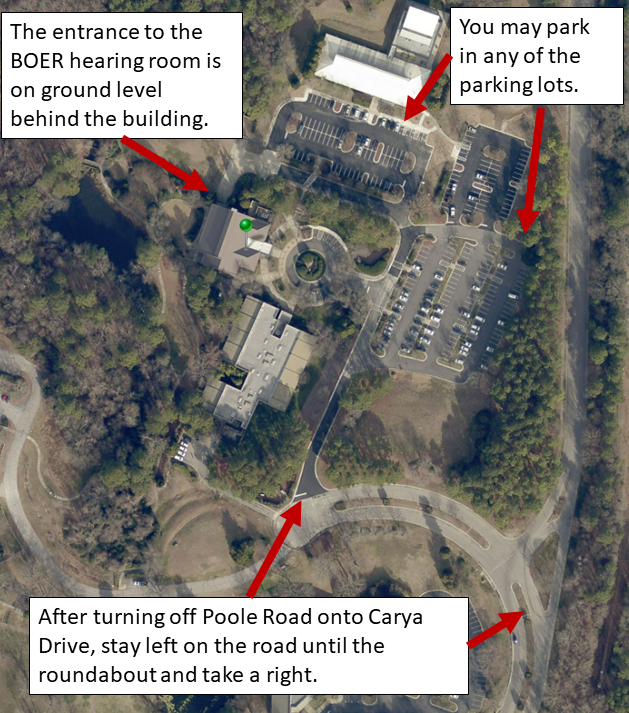

BOER hearings will be held at the Wake County Commons Building, located at 4011 Carya Drive, Raleigh NC. There is no charge for parking. Taxpayers will be notified of the date and time of their hearing via a letter mailed to the mailing address on file with Tax Administration. Taxpayers are not required to make a personal appearance at the hearing.

Refer to the following image for assistance finding the BOER meeting room at the Wake County Commons Building.

Property Tax Commission

Following a hearing with the BOER, property owners may appeal to the North Carolina Property Tax Commission should they remain in disagreement with the value of the real estate. The Commission is composed of five members: three appointed by the Governor and two appointed by the General Assembly. Applications for hearings must be filed with the North Carolina Property Tax Commission within thirty (30) days after the Board of Equalization and Review has mailed notice of its decision. Appeals from Commission decisions are to the North Carolina Court of Appeals and are based on hearing records.

How to Request an Informal Review or Submit a Formal Appeal

All property owners have the right to appeal the appraised value of their property. If you believe the value does not reflect fair market value and have information to support your position, or you can document damage or factors that may influence the value, you may want to consider an appeal. An appeal would not be effective if you think your value is accurate but the taxes are too high. The appeals process pertains only to the appraised value.

The deadline to file an appeal to the Board of Equalization and Review for values updated as part of the most recent revaluation was May 15, 2024. If you have received a Notice of Assessed Value dated after May 15, 2024, you may contact the Wake County Department of Tax Administration for information on how to appeal the value. If you have received a decision letter for a Board of Equalization and Review appeal and wish to file an appeal to the North Carolina Property Tax Commission, please follow the instructions contained in the letter. For all other property owners, the next window to appeal your value will open Jan 1, 2025.

Additional Information

The Wake County Tax Portal, where taxpayers may submit online requests for informal reviews and/or formal appeals, has a series of frequently asked questions about appeals. The information is comprehensive and includes tips on the types of documentation that are helpful in supporting an opinion of value, any required forms such as a Power of Attorney for those who are not a listed owner or licensed North Carolina Attorney, and additional information about how to submit requests for informal reviews and formal appeals online. Please note, all Power of Attorney Forms submitted must be signed and notarized no earlier than January 1, 2023. In addition, a copy of Frequently Asked Questions About Appeal Hearings, has additional information taxpayers may find useful about formal BOER hearings.

Board of Equalization and Review (BOER) hearings related to the 2024 revaluation are underway. Taxpayers who timely appealed their 2024 assessed value, but who have not yet had a hearing in front of the BOER, may still be sent an initial bill or notice per NCGS 105-378. Taxpayers may pay these property taxes and if the appeal is decided in their favor, the County will refund the amount of overpayment plus interest in accordance with NCGS 105-290(b)(4). Appellants may also wait to pay their property tax bill, but if the bill is not paid by January 6, 2025, the bill will be subject to interest and additional cost.